Exactly how Tornado Cash works and what that means for the sanction

Yesterday Coin Center published a detailed explanation of exactly how Tornado Cash works. We worked with a number of solidity experts to ensure this is a just-the-facts description of exactly how the smart contracts work.

We used that understanding as a basis to map Tornado Cash’s function to OFAC’s statutory authority. It looks to us that the Treasury Department is indeed on weak legal footing for this particular sanction. Yesterday Peter Van Valkenburgh sent an a la carte newsletter laying out the resulting legal analysis.

Here’s an (very) abridged version:

The addresses themselves, and the software that they point to on the Ethereum blockchain, are not “property in which some foreign country or national has an interest.”

To the extent anyone has property in those addresses, it is because they’ve sought the privacy provided by those software tools. That property is their own and no one else has any control or ownership rights to that property.

When a person uses the Tornado Cash contracts to protect their privacy, they arguably are not even engaged in the kinds of activities that IEEPA empowers the President to block.

To the extent that some Tornado Cash users are sanctioned persons, and they have some property at those smart contract addresses, then that property and that property alone is legitimately the target of sanctions.

Read more of the summary: How does Tornado Cash actually work?

Full Tornado Cash explainer: How does Tornado Cash work?

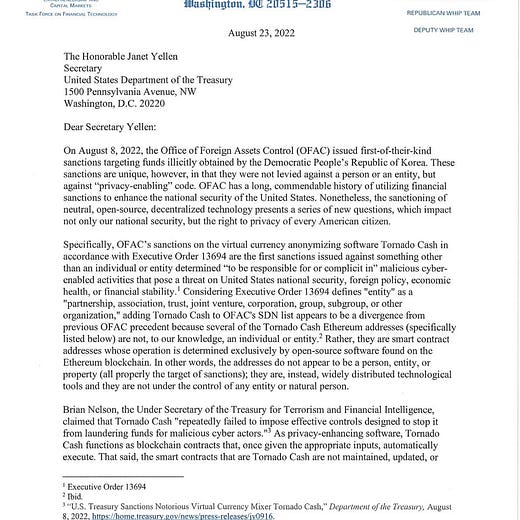

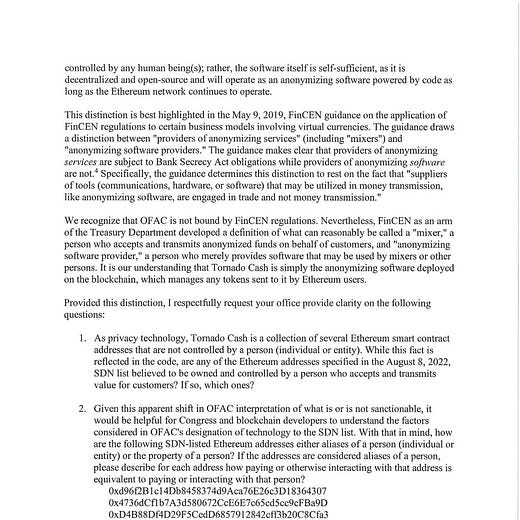

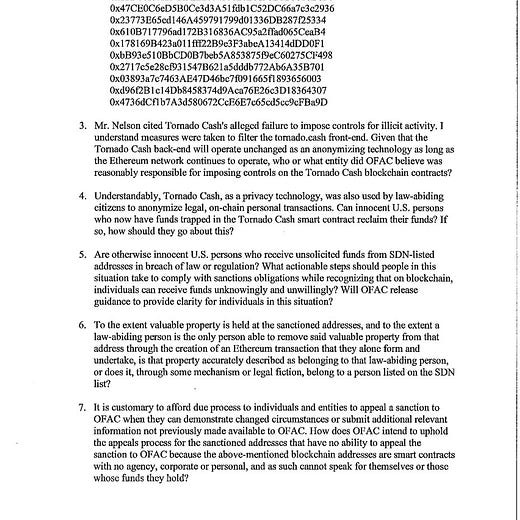

On Capitol Hill, we worked with longtime cryptocurrency champion Rep. Tom Emmer to send a letter to OFAC echoing our concerns with the Treasury Department’s reasoning.

Our friends at the Electronic Frontier Foundation have also joined the fray. Cryptographer Matt Green has re-uploaded the previously censored Tornado Cash repo to GitHub. Should the government attempt to censor this publication of that code, EFF has agreed to represent Matt on free speech grounds. This is complementary to Coin Center’s focus on getting the sanctioned smart contracts off the SDN list.

Mike Mosier of Espresso Systems, formerly acting director of FinCEN, reminded us how his former employer viewed autonomous code vs. an entity that would be subject to regulation.

If anyone knows it would be him. For more details, see our analysis of FinCEN’s 2019 guidance.

Earlier in the week, Peter appeared on the Epicenter podcast for a lengthy discussion of the Tornado Cash sanctions.

And he also appeared on MoneroTalk to discuss implications for other privacy focused projects.

As always, if you wish to support Coin Center’s policy advocacy mission please consider making a donation: coincenter.org/donate